Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

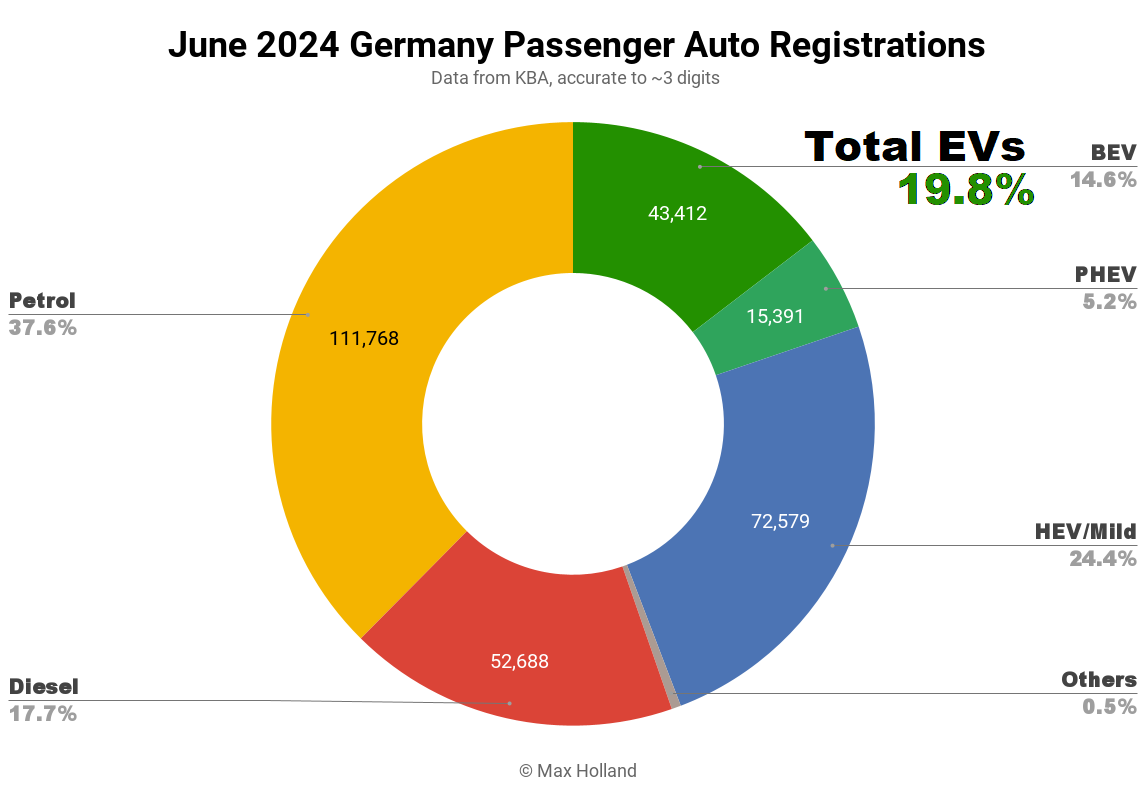

June saw plugin EVs take 19.8% share in Germany, down YoY from 24.6%, as macroeconomic woes, stubbornly high entry EV prices, and incentive cancellation, all took their toll. Overall auto volume was 297,329 units, up by some 6% YoY, but still at least 10% below 2017–2019 seasonal norms (~330,000 units). The bestselling BEV in June was again the Volkswagen ID.3.

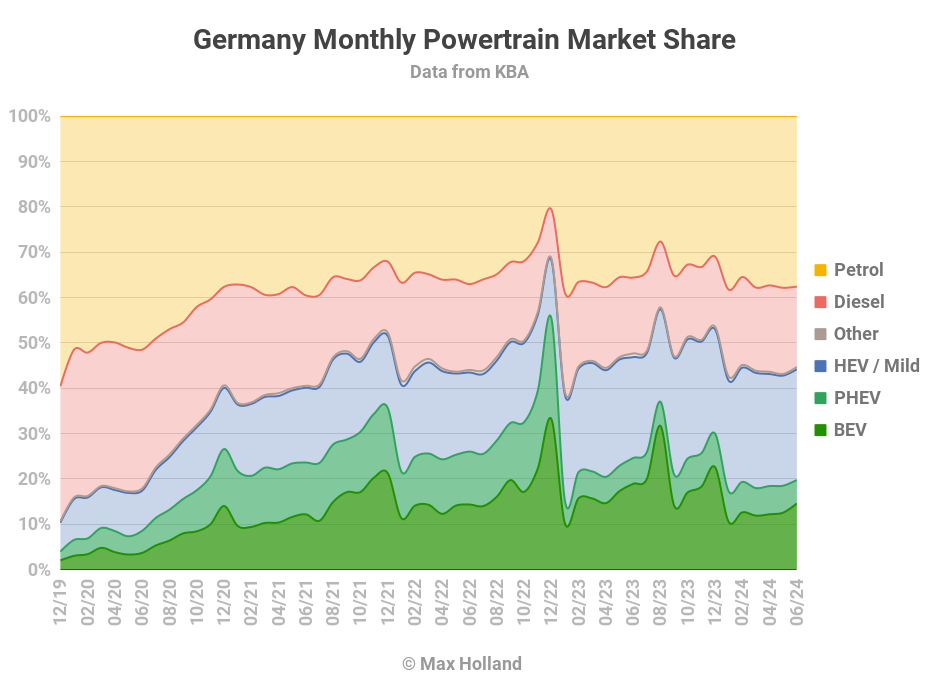

The market saw combined EVs take 19.8% share in Germany, with full electrics (BEVs) at 14.6% and plugin hybrids (PHEVs) at 5.2% share. These compare with YoY figures of 24.6% combined, with 18.9% BEV and 5.7% PHEV.

A reversing market share of BEVs in Europe’s largest auto market is not good news. The reasons are as mentioned in the introduction: a weak macroeconomy (with weak consumer confidence), still-overpriced entry BEVs, combined with a psychological hangover from the abrupt incentive cancellation in mid December.

On BEV overpricing, I’ve previously given the example of the Fiat 500e 42 kWh (€34,990) costing more than twice the base combustion version (€17,490). The case with the Volkswagen Up! is no better, with the ICE version recently listed as starting from €14,555 and the BEV version from €29,995 – again, more than twice the price.

For context, for that €29,995 MSRP, you could almost buy 3 (yes, three) BYD Seagull BEVs in China, each with the 38.9 kWh battery (a larger battery than the 36.8 kWh e-Up!). The Seagull’s MSRP is €10,877 (and even less for the smaller battery variants). Obviously the powertrain cost of the BEV Up! (with a smaller battery) cannot on its own actually be costing Volkswagen around 1.5x the entire price of a BYD Seagull (a larger car with a larger battery and more modern technology). It’s yet another example of the big legacy auto companies price gouging, and dragging their feet on offering competitively priced BEVs.

In Germany’s economic recession (Q4 and Q1 were both GDP negative, and Q2 looks set to be also), with dwindling consumer spending capacity, most folks on a tight budget looking for a simple small or compact car like the Fiat 500 or VW Up! are not going to pay a €15,000 (100%) premium to go electric. These excessive European BEV prices, especially in a recession, are hindering the progress of the EV transition. In China, BEVs are already at price parity with their ICE competitors.

Back to the June market share, both petrol and diesel vehicles grew volume by over 12% YoY, with growing shares of 37.6% and 17.7% respectively. This retrogression is obviously shameful, especially since Habeck, Germany’s economy minister (and vice Chancellor), is the head of the Green party. Shame, shame, shame!

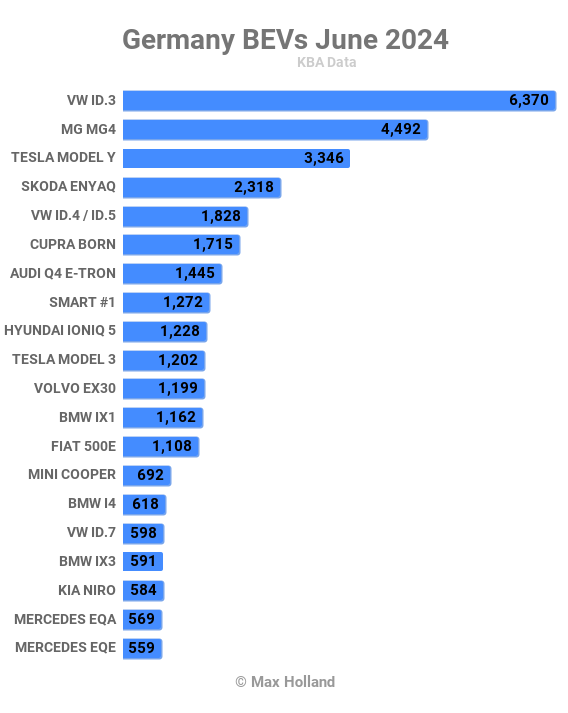

Best Selling BEVs

The Volkswagen ID.3 was the best selling BEV in Germany for the second consecutive month, with 6,370 units in June.

In second place was the MG4, with 4,492 units, and the Tesla Model Y came third, with 3,346 units.

Most positions in the top 20 saw only slight change from a month ago. Exceptions included the Hyundai Ioniq 5, which apparently had a shipping arrival, and recovered to 9th spot, from 21st in May. Likewise the Mini Cooper recovered from 25th to 14th. At a low ebb was the Mercedes EQA, falling from 8th to 19th.

Several new BEV models had their German debuts in June. The BYD Tang has been refreshed several times since 2021 (when it first dipped its toes in the Norwegian market), and now comes to the German market in the new 2024 version (41 units in June).

The BYD Tang is a premium large (4,900 mm) 7-seat SUV, with battery options from 90 to 109 kWh (LFP), for a rated range of ~450 to ~530 km (WLTP), priced from around €70,000. The pricing is in the ballpark for 7 seat BEVs, so let’s see how it gets on.

Another debutant is the Opel Grandland X, with 28 units registered in June. This mid-sized SUV shares Stellantis’ new STLA medium platform with the new Peugeot e-3008 and e-5008, and is sized in between those two, at 4,650 mm. It has battery capacities of 73 to 98 kWh, and rated range from 525 to 700 km (WLTP). Opel’s website does not yet clearly state the price (nor list this model) as of time of writing, so these are likely showroom units for now. The rumoured starting price is around €50,000 (just €1500 more than the Peugeot e-3008).

The Nio ES8 also saw initial German deliveries (18) in June, although these also seem to be showroom units for now. Confusingly, this is also known as the EL8 in some markets, and Nio’s European website has both names for the same vehicle. It is a large premium SUV (5,099 mm), but price is as yet unlisted, likely because the EU commission’s exact levels of tariff on Chinese-made EVs are still not fully decided.

Likewise there were small deliveries of the Aiways U5 SUV, and the Xpeng G9 SUV in June, which are also likely showroom units for now, with no clear pricing.

Finally, Audi registered the first 10 units of its new A6 e-tron sedan in June, sharing the PPE platform with its new Q6 e-tron sibling. Like most of June’s debutants, these are likely showroom units, since this model is as yet unlisted on Audi’s customer facing website — we don’t yet know the exact pricing or specs. The Q6 sibling starts from around €70,000, however, so that’s a likely ballpark starting price for the A6 also.

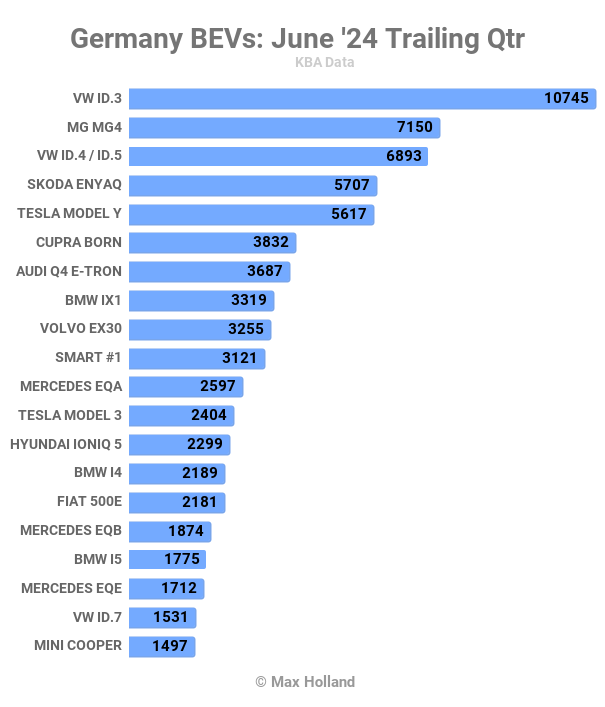

Now let’s look at the 3-month chart:

After three strong months, the Volkswagen ID.3 has climbed to the top of the ranking, from 7th in Q1. The MG4 climbed to 2nd from 12th previously, obviously pulling forward deliveries ahead of the steep tariff increases (an additional ~38% for this model) due to be applied from July 4th. For my thoughts on the EU’s self-harming tariffs insanity, see the France report.

Two other BEVs also about to be subjected to the higher tariffs saw a similar pull-forward of sales in June, the Volvo EX30 (from 16th rank up to 9th rank) and Smart #1 (21st up to 10th).

Most other ranking shuffles were more muted, although the Volkswagen ID.7 continued to ramp up, and entered the top 20 for the first time, in 19th spot (from 39th previously).

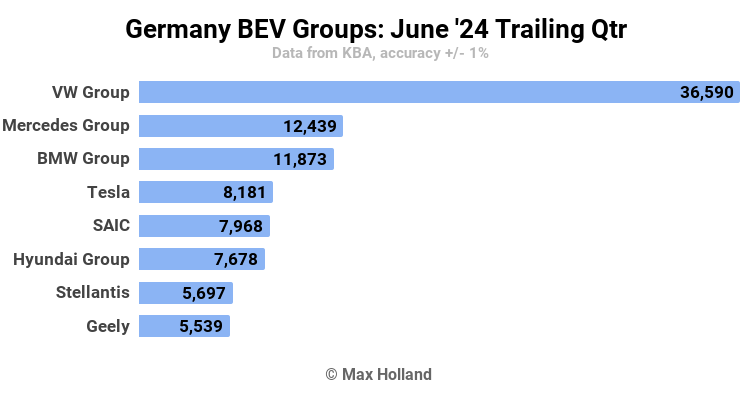

Let’s have a quick look at manufacturing group performance:

In Q2 Volkswagen Group strongly increased its lead to 35.9% share of the BEV market (from 26.5% in Q1). Tesla fell back from 2nd to 4th (16.2% share to 8.0%), allowing both Mercedes Group and BMW Group to advance one position with their shares mostly unchanged.

SAIC (owner of the MG brand) climbed to 5th, from 9th previously (doubling share to 7.8%), likely foreseeing the steep tariff increases that would be imposed on its vehicles from July onwards. This SAIC jump up meant that several other brands now each shuffle down by one spot.

The standout laggards, Toyota Group, were far away at the bottom of the pack, with Q2 total BEV deliveries of 324 units. Toyota Group sold 49,225 vehicles in Germany in 2024 YTD, with only 1,099 of them BEVs (2.2% share). Slow clap for Toyota — if you’re going to drag your feet, why not do it blatantly?

Outlook

The 6% YoY growth of the auto market was stronger than the overall German economy, which was in formal recession across Q4 2023 and Q1 2023 (both showing GDP at negative 0.2% YoY). Latest provisional reports point to a weak Q2 also, although we have to wait a bit longer to get the official data.

Inflation fell to 2.2% in June, from 2.4% in May. Interest rates fell to 4.25% in June, from 4.5% in May. Manufacturing PMI weakened to 50.4 points in June, from 52.4 points in May. Consumer confidence going into July dropped to -21.8 points, from -21 going into June.

The outlook for BEVs this year remains weak, with the triple threats of economic weakness, overpriced entry BEVs, and incentive cancellations, all continuing. Now with Chinese-made BEVs facing much higher EU tariffs (including popular models like the Volvo EX30, MG3, BMW iX3, and Tesla Model 3, amongst others) we can add a fourth negative influence to that list. I’ve given my take on the EU’s tariffs in the France report, so won’t repeat myself again here.

What are your thoughts on Germany’s EV transition? Please join in the discussion in the comments section below.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy