US manufacturers are competing for market share of full-size

half ton pickups.

The full-size half ton pickup segment in the US gets significant

attention from the media, analysts, and several manufacturers. Yet,

it is only the fourth-largest segment in the industry.

The exceptional attention paid to this vehicle category is due

to several facts, including:

- Three of the pickup models are volume leaders for their

respective brands as well as industry wide. - The segment is one of the few in which domestic manufacturers

still hold a commanding position. - Owners tend to have high brand loyalty.

- The vehicles are highly profitable for their respective

OEMs. - The underlying architectures of these models are also the basis

for full-size SUVs, resulting in scale that drives high

profits-per-vehicle across both segments.

Given this landscape, it is noteworthy that the relative

positions of several entries in this segment have shifted

recently—particularly the Toyota Tundra.

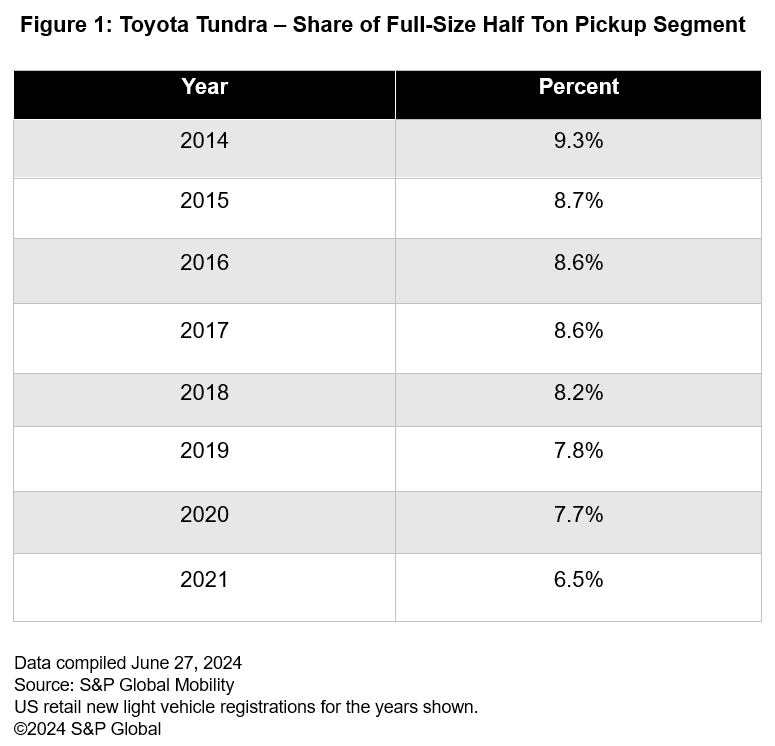

The Tundra has not historically been a leader for the company,

compared to most other Toyota products which rank in the top three

in their respective segments. The Tundra has lagged behind most

competitors and its position deteriorated from 2014 through 2021

(See Figure 1).

However, Toyota introduced an all-new Tundra in the US in late

2021 as a 2022 model year vehicle (significant new retail

registrations first appeared in December 2021). Designed and

engineered in the US, this vehicle offers content, technology, and

a breadth of features that are much more in line with domestic

competitors than past Tundra models.

New features of the 2022 Tundra include:

- Aluminum-block, twin-turbo 3.5-liter V6 engine as standard,

mated to a 10-speed automatic transmission; this engine delivers

389 horsepower and 479 pound-feet of torque, more power and torque

than some competitive V8 powertrains. - High-strength, fully boxed, steel-ladder frame, using aluminum

in key areas for weight reduction. - Sheet-molded compound bed with reinforced aluminum cross

members. - Interior with an instrument panel dominated by a horizontally

mounted 14-inch touch screen. - Capstone high-end series, with upgraded materials, luxury

interior, and improved technologies as standard; this series

provides competition to the F-150 King Ranch and Platinum and

Sierra Denali series.

Loyalty Also Improves for Tundra in Tandem with Share

Growth

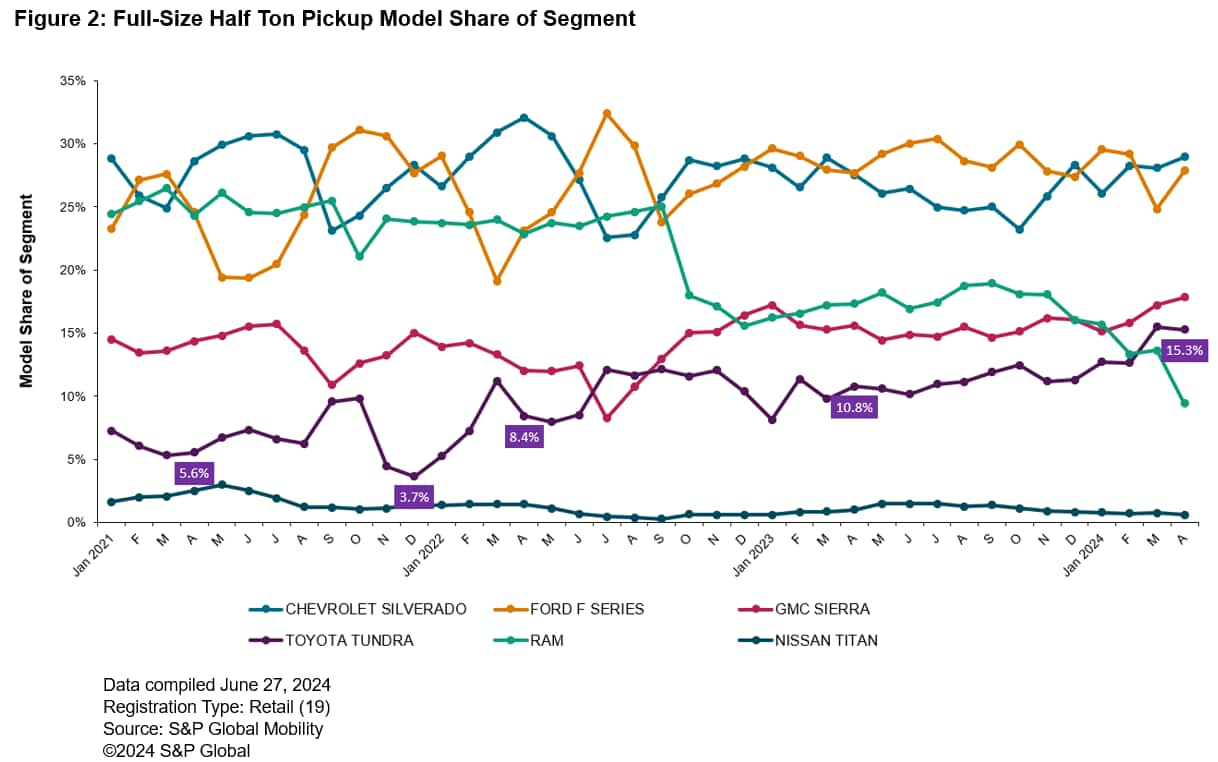

S&P Global Mobility registration and loyalty data clearly

indicate that the Tundra's market performance began to improve at

almost the same time as the new version arrived at Toyota stores.

As Figure 2 indicates, Tundra's retail share of the full-size half

ton pickup segment more than doubled from 3.7% in December 2021 to

8.4% in April 2022.

In April 2024, Tundra's retail share reached a record 15.3%,

more than four times its share back in December 2021 when the new

version arrived. It is also noteworthy that Tundra now (as of

April) ranks #4 in the segment, ahead of all models except the

Silverado 1500, F-150, and Sierra 1500.

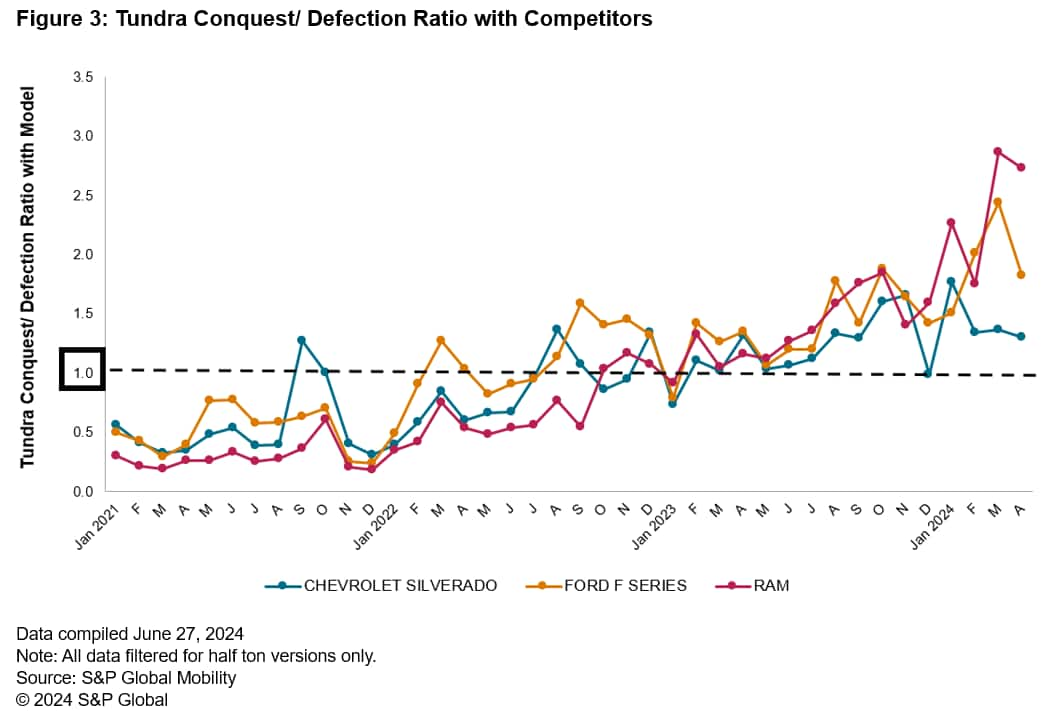

The improvements in Tundra's conquest/ defection ratios

(conquests or inflow divided by defections or outflow) with key

competitors also illustrate Tundra's significantly improved

performance since the arrival of the re-designed version.

As Figure 3 indicates, in 2021 Tundra had a net outflow with

each of its three main competitors in every month except two.

However, beginning in the early months of 2022, with the new Tundra

now available, its ratio began to rise and has been greater than

1.0 (indicating net inflow) with all three models every month since

February 2024. Impressively, Tundra's ratio with F-150 and Ram 1500

surpassed 2.0 in several of these months.

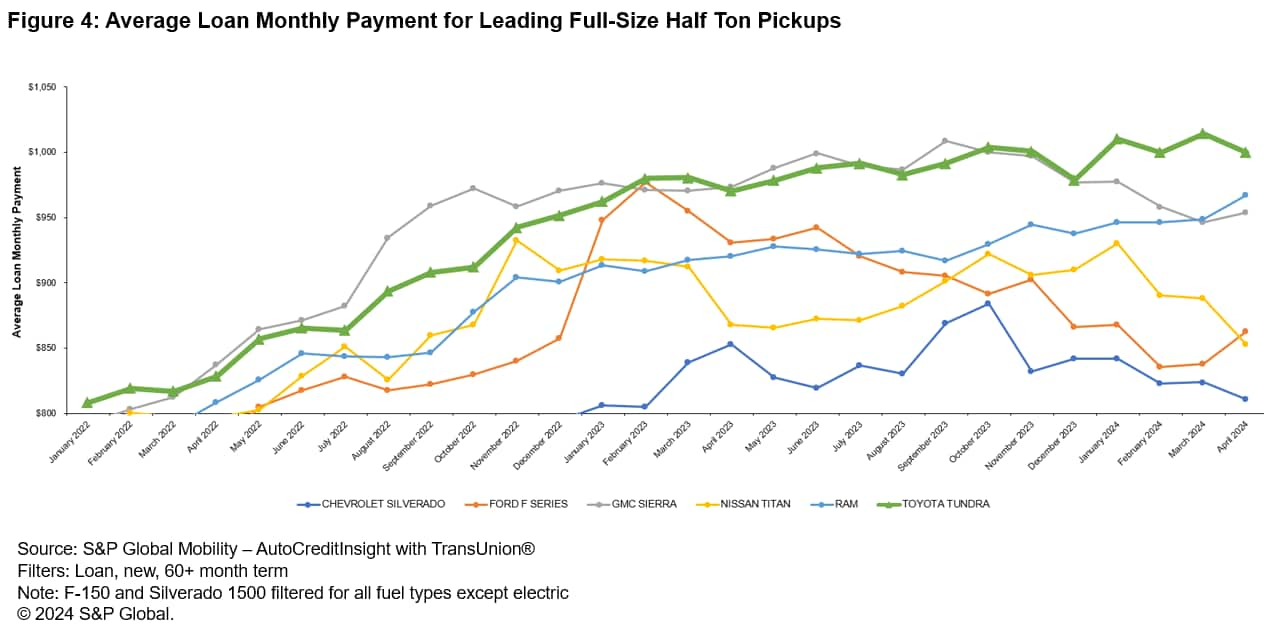

Finally, Tundra's loan monthly payment data suggest Toyota was

able to command a payment equal to the upscale Sierra 1500 for much

of the 2023 calendar year and above that of all other competitors,

followed by a segment-leading payment in each of the four months in

2024 for which S&P Global Mobility has complete data. Moreover,

Tundra's payment reached a near-term record of $1,014 in March of

2024 exceeding Silverado 1500 and F-150 monthly payments by 23% and

21%, respectively.

Maintaining share in this segment is crucial for domestic US

manufacturers to generate the profits needed to develop EVs, which

currently bleed red ink for most, if not all, manufacturers.

Toyota, on the other hand, sees this category as the one remaining

space left to conquer in the huge US retail new vehicle market.

The bottom line is that every make will be battling for every

possible full-size half ton pickup sale in the coming months.

Demo Our Loyalty Analytics Tool