Latest financial results from major automakers reveal a mixed

bag — but pressure on margins.

The S&P Global Mobility AutoIntelligence service

provides daily analysis of global automotive news and events. We

deliver timely context and impactful analysis for navigating the

fast-moving industry. Behind the Headlines offers a bi-weekly dive

into recent top stories.

In 2024, industry-wide pressures include two key trends: First,

sluggish consumer acceptance to new battery electric vehicles

(BEVs), and second, vehicle affordability concerns pushing against

natural demand and increased inventory.

With the latest round of earnings reports, most automakers are

seeing pressure on operating margins. At the top line, a difficult

market in mainland China and the uneven transition to BEVs would

seem to be the obvious cause. However, across the board, automakers

are facing drags on profitability that are both common to the

industry and company specific.

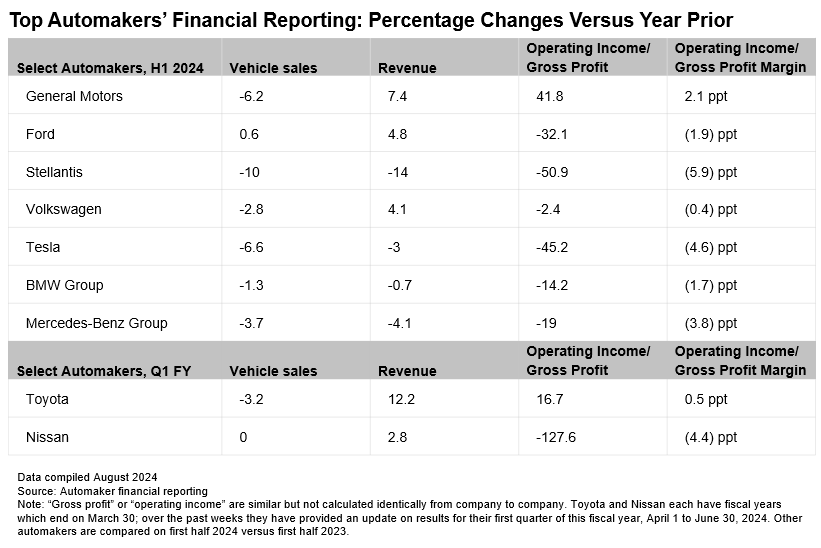

Let’s take a look at changes in vehicle sales, revenue,

operating income or gross profit and operating income or gross

profit margins.

Volkswagen and Ford see improved revenue but lower

margin

Volkswagen’s revenue improved despite declining sales — but

non-operating factors had an impact on operating results. VW says

that adjusting for those factors, operating margin improved from

first quarter to second quarter.

Within VW Group results, Audi saw a decline in operating margin,

as sales fell on supply constraints. Porsche’s operating revenue

and margin fell on costs for model ramp-up. Both Audi and Porsche

are introducing new products which affect costs today but leave

them better positioned for the future.

VW Group Core brands also saw operating margin fall, though the

company noted restructuring efforts as the cause rather than market

conditions. For VW Group, there seems to be less turmoil on the

balance sheet related to the BEV transition or the difficult market

in mainland China.

While Ford saw increased sales and revenue in the first half of

the year, its operating income took a significant hit. Ford is

struggling to see the level of traction it wanted for the Ford

F-150 Lighting and Mustang Mach-E BEV products, and in 2024, Ford’s

story is about the “freedom of choice” the company can offer in

propulsion solutions.

The company is expecting to see a US $5 billion loss from its

Model e electric vehicle division in 2024. However, the main reason

for the division’s decline in first-half 2024 performance was

unexpectedly high warranty costs in the second quarter, along with

higher costs for new-product materials and manufacturing.

Ford no longer reports financial results geographically but says

that it is profitable in mainland China and all of its

international regions.

BMW and Mercedes-Benz see sales, revenue, and margin

fall

BMW and Mercedes-Benz both reflected lower sales and revenue,

with Mercedes-Benz seeing larger declines in all four metrics.

These companies noted industry conditions in mainland China

adversely impacting performance. Both brands are heavily

electrifying, with BMW carrying a bit more breadth in its BEV

offerings at this point. The BMW purpose-built BEV Neue Klasse

architecture arrives in 2025, causing increased engineering and

development spend in 2024.

BMW leadership professed itself satisfied with the performance

of its core automotive unit in the first half of 2024, though BMW

has experienced a harshening of the global operating environment.

Though BMW has vowed not to engage in the price war in mainland

China, the automaker also noted weaker consumer sentiment in China

and heightened competition as drags on performance.

Although BMW declined in all four metrics, the declines were

less severe than many others. For Mercedes-Benz, the comparatively

more difficult quarter has led leadership to revise its

profitability target for 2024, though the Mercedes-Benz Cars

division is still ahead of its margin goal of 10%.

Mercedes-Benz Mobility division is being affected by ramp-up

costs for the Mercedes-Benz charging network as well as the

challenging market in mainland China.

General Motors and Toyota report sales declines, but

improved revenue and margin

General Motors sales declined in the first half of 2024, but

strong pricing improved revenue and cost discipline. The launch of

less-complex new-generation ICE vehicles contributed to a whopping

41.8% improvement in operating income and a 2.1-point increase in

operating margin.

GM increased its full-year 2024 guidance, though the company

also noted another delay in completing the conversion of a vehicle

assembly plant to build full-size BEV trucks to mid-2026. GM is

also still struggling in mainland China; during the earnings call,

CEO Mary Barra said GM is working with its JV partner to

restructure the business for sustainable profitability.

Toyota reported an overall decline in first quarter sales,

increased revenue, increased operating income and improved margin.

Toyota improved its profit despite an ongoing issue in the Japanese

market over certifications, which has required vehicles to be held

and re-certified or recalled.

Global vehicle sales dropped in the quarter on the interruptions

in Japan, with North America and Europe seeing sales improve.

Toyota is strongly advancing hybrid technology in 2024, and

electrified vehicle sales reached 43.2% of global sales for the

company.

However, Toyota operating income was negatively affected by

increased spending on higher labor costs and R&D expenses, both

relatively typical items for the cyclical auto industry, while

increased marketing efforts positively affected operating

income.

Tesla, Stellantis, Nissan see largest margin

declines

Tesla’s declining performance in the first half of 2024 is

directly related to sales declines and pricing actions. Adjusting

pricing has not provided the sales lift the company wanted, but it

has drastically affected gross profit and margin.

Some of Tesla’s sales struggles are related to natural consumer

demand for BEVs beginning to take a slower growth pace than earlier

years, but also related to fierce competition from technologically

advanced startups, highly cost-efficient and sufficiently

competitive mainland Chinese BEV automakers, and highly competitive

competition from traditional brands. Tesla’s financial results are

impacted by economic conditions, BEV demand and a more complex and

competitive vehicle landscape.

Though Stellantis did remain profitable, poor volume and mix

along with currency translation pulled revenue down by 14%.

Stellantis saw unadjusted operating profit fall about 51% and a

margin decline of 5.9 points.

Some volume decline was on discontinued models in North America

and inventory adjustments in Enlarged Europe. Stellantis

difficulties in North America include inefficient marketing

strategies and higher-than-necessary inventory growth.

Stellantis is among the automakers who has long struggled in the

mainland China market. Moving forward, CEO Carlos Tavares is

counting on a JV with Leapmotor to address mainland China as well

as to provide an inexpensive BEV for production and sale in other

markets, initially Europe.

Nissan saw flat sales versus the April-June 2023 period, and

revenue improved. However, Nissan’s operating income plummeted

compared with a year earlier and margin dropped. Nissan largely

blamed its North American performance for the weak result,

announcing plans for salaried staffing cuts shortly after reporting

results.

Nissan will optimize inventory buildup in North America in the

second half of the company’s fiscal year (October 1, 2024-March 31,

2025), including use of incentives, as well as maximize sales of

new and refreshed models to right the ship. Weak US first-quarter

sales were blamed on an aging portfolio and consumer interest in

hybrids, which Nissan isn’t currently offering in that market.

Get Free Trial of AutoIntelligence

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.