By: Jason Jordhamo, Product Management Director, S&P Global

Mobility

In this November issue of the

Polk Automotive Marketing Monitor, we dive into the service

bays; Vehicles on the road continue to get older and rack up miles

while new launches rolling into lots are laden with new systems,

semiconductors, and software. For dealers, the service bay is a

leading profit center, and using audience data to target consumers

who are in market for specific types of service (oil changes,

brakes, tires, etc.) can help drive traffic and service revenue.

Additionally, targeting car owners at specific vehicle ages

presents an opportunity to amplify the features and technology in

your messaging to capture new buyers.

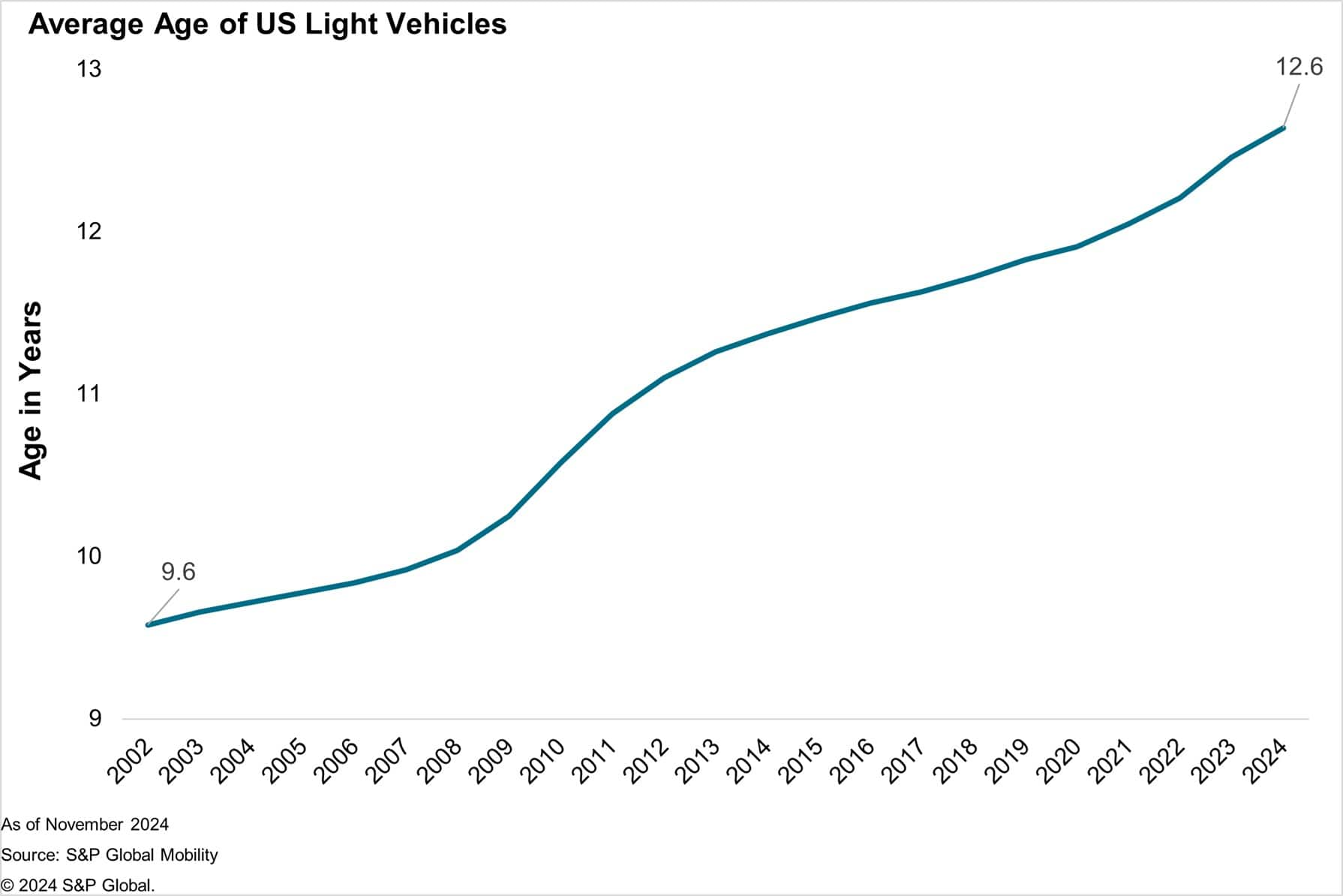

Average age of light vehicles in the US is now 12.6 years

The average age of light vehicles in the US has reached a

record high of 12.6 years. Additionally, Americans are on track

to drive over 13,000 miles on average in their vehicles this year

— a 7% increase from 2023.

As more vehicles enter the aftermarket sweet spot (ages 6 to

12), coupled with a modest scrappage rate of 4.6%, the demand for

maintenance and repair services increases, creating a lucrative

opportunity for retailers. However, these aging vehicles are

sharing the roads with increasingly tech-enabled cars, bringing

more complexity — and a need for diverse technical skill sets

— to service bays.

Navigating the complexity of an aging and tech-enabled

fleet

The technology composition of vehicles is shifting. Consider

this: In 2016, the average number of semiconductors used in new

vehicles was under 200. That number has since grown 11x, with

today's new vehicles averaging more than 1,900 semiconductors per

vehicle. By 2030, the number could rise to over 2,800 per vehicle,

according to S&P Global Mobility estimates.

Meanwhile, many aging vehicles are equipped with outdated

technology, which can complicate repairs, parts availability and

maintenance. However, concerns about new vehicle affordability has

owners weighing the costs of new vehicle ownership compared to

increased maintenance and repair costs on their current vehicles,

with many choosing the latter.

Gas, hybrid and electric powertrains add to the complexity,

leading to staffing and training challenges in the auto repair

industry. This presents an opportunity for dealerships and OEMS to

position their service department as a hub of expertise, increasing

customer loyalty and strengthening CRM databases along the way.

With the rise of software-defined vehicles (SDVs) on the

horizon, dealerships must also adapt to a market where consumers

expect advanced features like AI-driven object detection and

sophisticated infotainment systems. This shift requires service

bays to be equipped not only with traditional tools and the latest

technology to diagnose and repair complex systems.

Additionally, the transition to SDVs and the rise of

subscription-based services for software updates require ongoing

customer engagement. Dealerships can leverage these trends to

create value propositions that emphasize the benefits of regular

service visits, for repairs and enhanced feature updates.

Strategic marketing for an evolving consumer base

As vehicle types and features expand, dealerships must rethink

their marketing strategies. Targeting owners based on vehicle age

is essential to tailoring messaging and offers that best match

specific car types. Utilizing vehicle loyalty and powertrain data

will also be valuable in developing communication strategies that

connect with customers across diversified products.

For example, a household loyal to EVs won't need oil changes,

but they will still need tire and brake repairs and to pass state

inspections where required. Educating customers about the

importance of maintenance across different vehicle types will

strengthen the brand and build long-term loyalty. Marketers can

implement programs that inform customers about their vehicle's

evolving capabilities and the value of regular check-ins and

maintenance to ensure optimal performance.

By knowing their customers and vehicle types, dealers and their

marketing partners can position themselves as trusted advisors

through the service bay, fostering stronger relationships that lead

to repeat business, referrals and increased revenue. A great

customer relationship with a service department also provides more

opportunity for repeat business in the showroom when the customer

returns to market for their next new vehicle.

Polk Auto Direct helps dealers and their marketing partners

find and target the best households that are in-market for

service.

Learn About Polk Auto Direct