The ability of original equipment manufacturers to extract

revenue from a vehicle once it has left the dealer's lot is the

holy grail for the motor industry. It's by no means a new quest,

either. The industry has long recognized the imbalance between the

revenue that accrues to OEMs at the point of sale and the financial

riches harvested during a vehicle's life. Jac Nasser, ex-president

and CEO of Ford, even made cradle-to-grave services a cornerstone

of Ford's strategy in the late 1990s. More recently, many OEMs

would rather be seen as mobility companies than plain old

automakers, a nod to the spectrum of services in which they see

growth opportunities for their brands.

The opportunities for OEMs are more diverse now than ever in the

car's 120-year-plus history. The “connected” component of the

connected, autonomous, sharing and electrification (CASE)

megatrend, and, more latterly, the software-defined vehicle (SDV)

— or the now increasingly modish AI-defined vehicle —

emphasize this ability to extract more dollars from consumers, be

it for subscription or one-off payment services. That's the theory,

in any case. The reality, as BMW discovered with its notorious

heated-seat experiment, can be different.

To better assess demand and consumers' willingness to pay for

connected car features, S&P Global Mobility conducts a global

survey of 8,000 vehicle owners annually. Here

are some insights from the survey:

Connected services brands and perceptions

Most respondents had a favorable opinion of their existing or

most recent connected services brand, and 83% would likely

recommend it to a friend. Positive opinions were higher for

regional/local automaker brands.

Compared with last year's survey, the top three connected

services brands per country remained almost the same across the

board. However, the US and Brazilian markets saw a change in

preferences. In the US, OnStar retained its top spot, but FordPass

and Honda Connect were new entrants to second and third. In Brazil,

Volkswagen We Connect, Toyota's T-Connect and Honda Connect were

all newcomers in the top three.

There was a slight decline in the likelihood of recommending

connected services brands: a warning to automakers. In this year's

survey, 43% of respondents were “very likely” to recommend their

chosen brand's services, compared with 47% in the prior year. The

countries where respondents were most likely to recommend connected

services were Brazil, with 94%, and mainland China and India, with

91%.

Satisfaction and willingness to pay

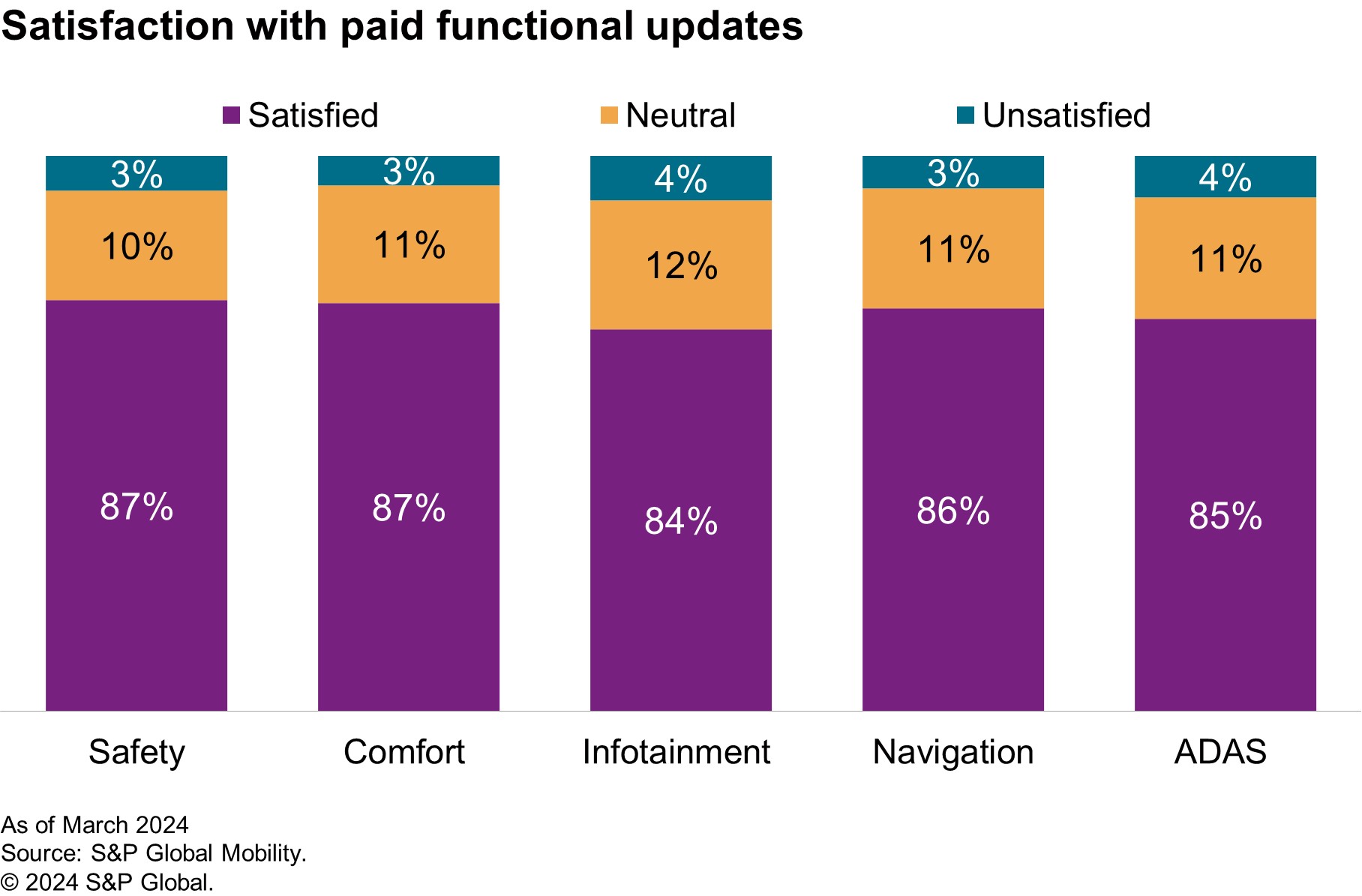

S&P Global Mobility's survey indicated declining

satisfaction levels across all connected services categories

compared with the previous year. The highest satisfaction was

reported for navigation, personalization and infotainment, while

the lowest was for safety and security. Paid functional updates

showed high satisfaction in safety, comfort, infotainment,

navigation and advanced driver-assistance systems (ADAS).

Willingness to pay was highest for safety and electric vehicle

services and lowest for navigation and infotainment.

Consumers expressed a strong desire for navigation and safety

and security services in their next vehicle, while productivity

services were the least desired. The desirability of EV services

and personalization are on the rise. For paid functional updates,

enhanced navigation, smartphone integration and basic ADAS

functionality were highly desirable. About 39% of respondents

preferred an annual subscription for these updates.

Data privacy concerns

As in the previous survey, data privacy remains a significant

concern, with 73% of respondents willing to share vehicle data in

exchange for free connected services. The main reported concerns

revolved around security, data misuse/trust and understanding the

value of data sharing.

Finally, even though trust in sharing information has increased

overall, respondents still feel more comfortable sharing it with

automakers than with technology companies.

The survey demonstrates that the search for incremental revenue

will be far from the walk in the park that some leading proponents

of the SDV paradigm suggest. As ever, consumer loyalty and trust

are hard-won. The industry is on the very first steps of that

journey with paid updates and subscriptions. Any false step now

could prove very costly for automakers as they work to diversify

their sources of revenue. The holy grail of paid updates and

subscription services could be another empty vessel from which the

industry drinks.

The survey included nearly 8,000 adult respondents from

eight territories, reflecting a diverse range of regional

specifics. The online survey was conducted in local languages, and

quotas were based on demographics such as gender, age, household

income and region. Key criteria for participation included owning a

vehicle from the model year 2019 or newer, ensuring the sample

targeted were potential end users of the technologies under

consideration.

Get daily insights and intelligence by subscribing to

AutoTechInsight.

Subscribe to the BriefCASE email newsletter.

Author: Vivek Beriwal, Senior Research Analyst II,

S&P Global Mobility