Software-defined vehicles herald a new age of mobility.

Advancements in connected car technologies and over-the-air updates

drive this shift, with Level 3 automation another milestone toward

fully autonomous vehicles.

Software-defined vehicles (SDVs) are revolutionizing the driving

experience. The trifecta of autonomous driving with connected car

capabilities and over-the-air (OTA) updates enhance vehicles'

operability and functionality. How can OEMs and suppliers

capitalize? More importantly, what role will they play in

autonomous driving?

Automakers have offered relatively simple Level 2 systems for

more than a decade, but it was the advent of Level 2+ that really

moved the industry from ADAS to Automated Driving. By integrating

advanced sensors and vehicle software into a more holistic system

design, L2+ vehicles from Tesla to Cadillac could achieve new

functionality combining steering and acceleration and more—but

this partial automation still requires the driver to remain

engaged. Today, BMW, Mercedes, and more are joined by a host of

tech-forward Chinese brands from NIO to Huawei that are actively

developing Level 3 automated vehicles to manage more complex

driving scenarios and to relieve the driver of constant

supervision.

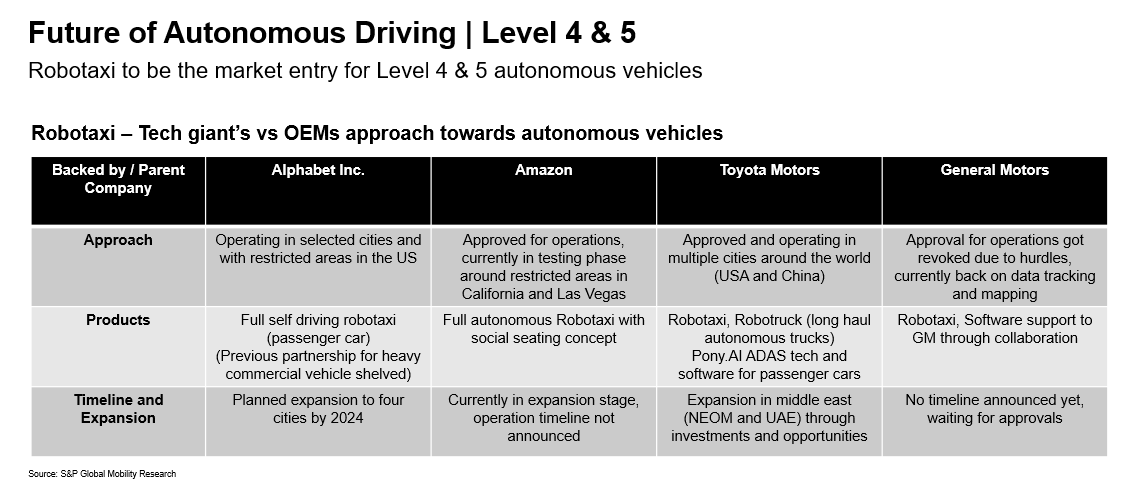

While the vast majority of the industry is focused on L2+ and

some on L3, Levels 4 and 5 automation, i.e., fully self-driving

cars, remain a long-term industry goal and a near-term focus for a

select few. If fully developed and safely implemented, the

technology's potential is tantalizing. Tech giants like Alphabet's

Google and Amazon are backing innovative startups such as Waymo and

Zoox to push the boundaries of Level 4 autonomy. At this level,

vehicles are fully autonomous and operate independently in

geofenced areas. They integrate advanced software—evolving from

machine learning algorithms to full stack training using Large

Visual Models—with the latest sensor technologies to navigate

without human input. The industry envisions a future where cars are

not just vehicles but sophisticated mobility solutions—for

instance, driverless robo-taxis navigating city streets and

transporting passengers without human intervention.

Across the industry, Advanced Driver Assistance Systems (ADAS)

are rapidly developing in both safety and driving efficiency.

System capabilities like hands-free driving with the support of

Driver Facial Monitoring systems are increasingly sophisticated.

Tesla, a leader in this field, has improved its software to handle

dense urban driving and intersections as well as more traditional

highway cruising functions that are the early focus of other

automakers.

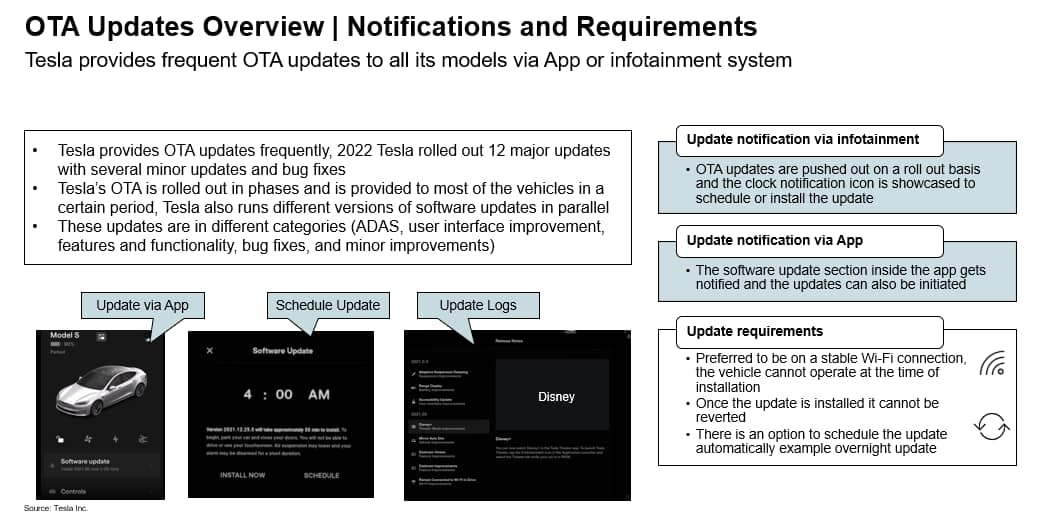

Another transformative aspect of SDVs is the ability to improve

and upgrade continuously through remote OTA updates. Manufacturers

can update software, fix bugs, enhance functionalities, and even

add new features without requiring physical modifications to the

vehicle. Tesla delivers frequent updates in select groups of

vehicles in phases through the infotainment or app. This approach

has caught on with other OEMs like Rivian, which adopt similar

strategies.

The new age EV manufacturers focus on vertical integration and

advanced technology that gives them the advantage of systems

compatibility. Integrating OTA updates comes with challenges.

Managing software across various hardware components, often from

different suppliers, requires a sophisticated coordination and

testing process to ensure compatibility and performance. Despite

this, the benefits of OTA updates are immense. It eases the burden

of recalls and enables manufacturers to swiftly respond to user

feedback and emerging technologies, while also opening up a new

revenue stream.

As vehicles become more software-centric, connected car

technologies are increasingly critical. Connected car technologies

refer to integrating advanced communication and information systems

within vehicles. They enhance vehicle functionality by providing

safety features, entertainment options, and real-time diagnostics.

The industry's push towards using telematics and

vehicle-to-everything (V2X) communication enables vehicles to

interact with the city infrastructure and other vehicles to enhance

road safety and traffic management.

Efficiencies in software architecture are necessary to support

modern cars' growing interconnectivity and advanced

functionalities. Developing this standardized architecture is a

crucial priority for OEMs and suppliers. Investments and strategic

partnerships from chipmaker Qualcomm and software giant Microsoft,

will improve on connected vehicle technology by defining digital

cockpit, providing advanced systems enabled by gen AI and equipped

with latest sets of connect features and advanced driver assistance

systems for the industry.

Despite these advancements, there are obstacles to widespread

adoption of autonomous vehicles. Legislation and infrastructure

vary significantly across different regions, creating a patchwork

of regulations that manufacturers must navigate carefully.

Deployment of Level 3 and Level 4 vehicles will be extremely

localized so the fragmented regulatory landscape and harmonization

across global markets is a challenge but it's not a non-starter.

Vehicle-based perception and planning is also being developed to be

infrastructure-agnostic, but connectivity and network coverage do

represent more headwinds, especially as automakers seek to achieve

global scale and simpler supply chains.

The shift towards software-defined vehicles is one enabler of

growing vehicle autonomy and increased connectivity. OEM, supplier,

and industry innovations will redefine our relationship with cars,

making them more adaptable, safer, and more attuned to the needs of

their users.

This article is part of a series featuring highlights from

S&P Global Mobility's 2024 Solutions Webinar Series. Unveiling

the Latest Trends in Autonomous Driving, Connectivity and Over The

Air Updates webinar occurred on April 25, 2024.

Register for additional webinar sessions.