Though it has been well reported that buyers in Europe and China

have adopted BEVs more quickly than US buyers, the same is true

when looking at the US versus Canada. In Canada, the presence of

provincial incentives in Quebec and British Columbia seem to be

contributing to overall Canadian electrification adoption, but also

to the representation of BEVs in those two provinces. In the US,

with its 50 states and more complex market, state-level incentives

seem to have less impact on the geographic distribution of BEV

registrations.

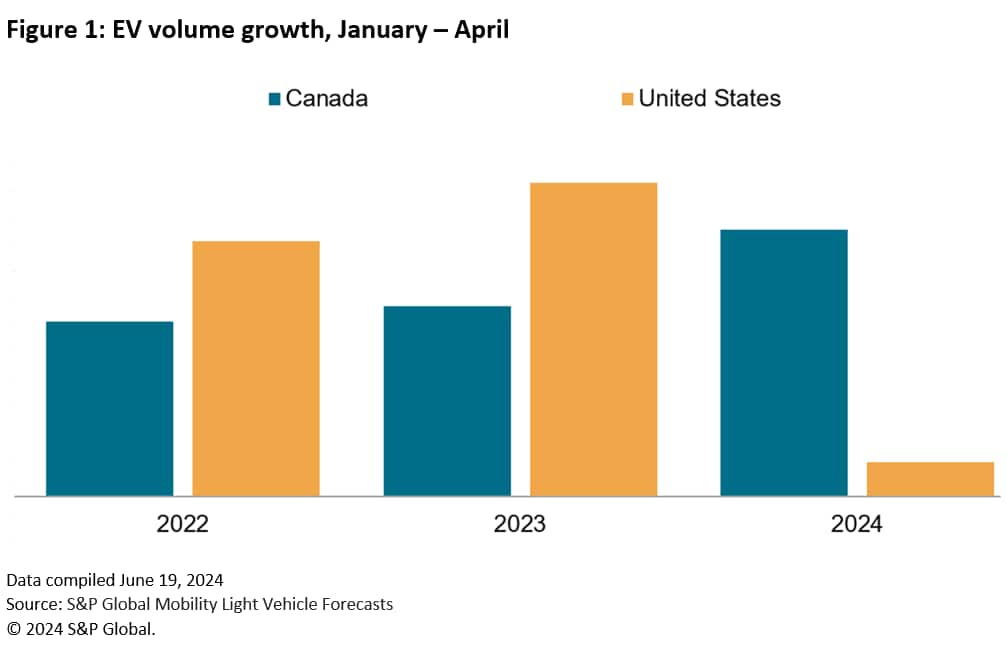

We have taken a dive into the registration data in Canada and

the US from January through April 2024, comparing it against the

same periods of 2021 through 2023, to explore differences between

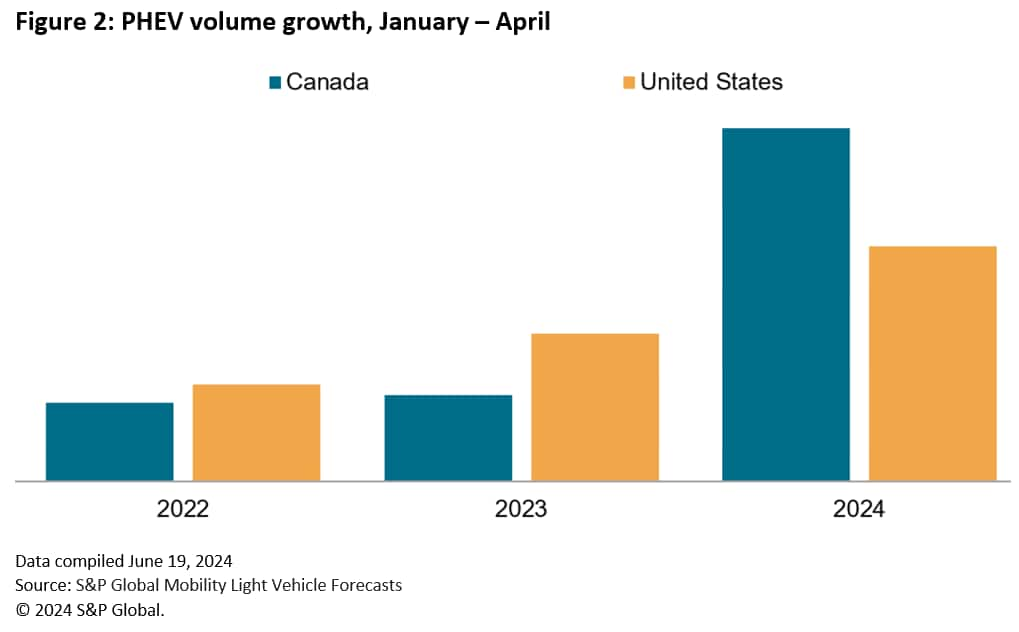

the two markets. In both countries, both BEV and PHEV share

continues to expand and the volume of registrations grows.

However, in the US growth is happening more slowly than in

recent years. In Canada, BEV registrations improved 57% from 2023

to 2024, bringing share up as well. In Canada, PHEV registrations

increased 75% over the first four months of 2024. In the US, BEV

market share and volume growth have both slowed. The US saw about

25,000 more BEVs registered in January to April 2024 than the same

period of 2023; volume increased about 137,000 units in the January

to April 2023 period compared with 2022.

Canadian provincial incentives could reduce BEV price

by CA$12,000

Canada's overall vehicle market is notably smaller than the US

market, but broader application of the Canadian national zero

emissions vehicle (ZEV) rebates—as well as Canada's decision to

work toward a ban on ICE vehicles by 2035—are helping support

faster adoption. Canadian provinces Quebec and British Columbia

both offer incentives on top of the national government program and

those provinces see above-industry BEV penetration rates.

Canada's national Incentive for Zero-Emission Vehicles (iZEV)

sees some EVs eligible for up to CA$5,000 rebate at point of sale

for a purchase or a lease of more than 12 months (though the amount

is prorated and based on the lease term). As with the US, the list

of vehicles which are eligible changes. Canada's national program

has electric range requirements (which impacts PHEV eligibility) as

well as vehicle price restrictions.

Quebec's program is more transparent and has fewer restrictions;

instead of calling it a rebate, it is called a financial assistance

program. In 2024, up to CA$7,000 can be applied to purchase or

lease of a BEV or CA$5,000 for a PHEV. It has no income

restrictions but does have pricing restrictions and is being phased

out.

Among the reasons Quebec has been aggressive on the BEV front is

that the province gets a substantial amount of its electricity from

hydropower and can support BEVs with renewable energy. In Quebec,

assistance drops in 2025 and 2026, and in 2027 is phased out

completely. In British Columbia rebates depend on the buyer's

income as well as vehicle price and type, with up to CA$4,000 for

BEV or extended-range EV and up to CA$2,000 for PHEVs. The province

of Ontario, however, has resisted offering any incentive; residents

there can only access the national plan.

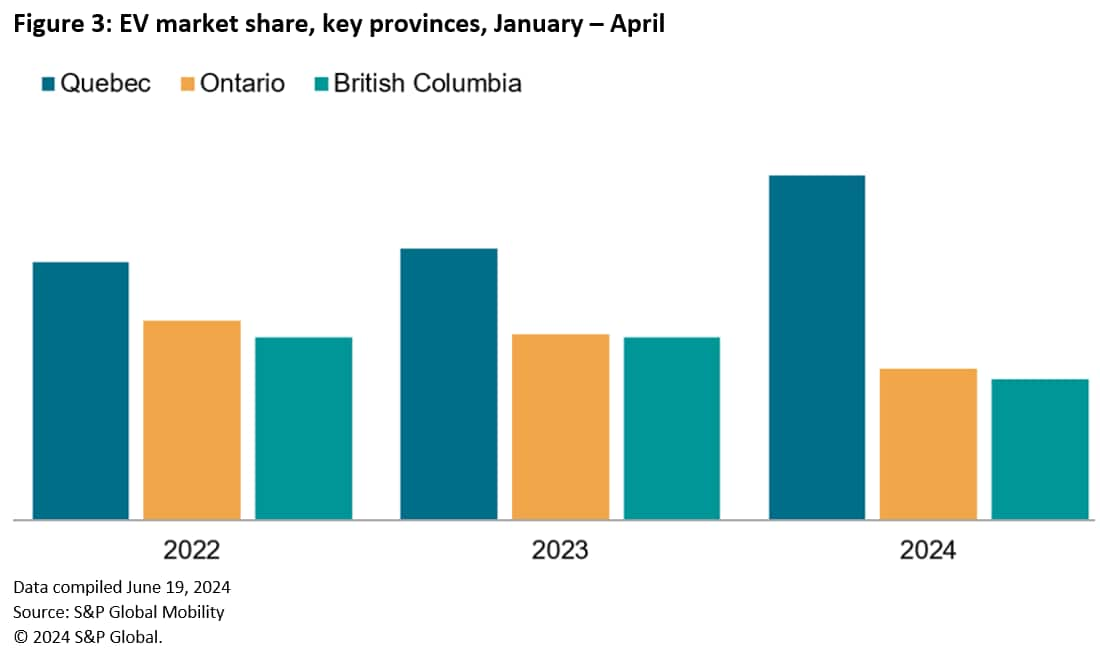

Canada's national program and a national policy more

consistently supportive of BEVs contribute to BEV and PHEV

adoption. However, the provincial-level incentives seem to drive

regional adoption, with Quebec consistently accounting for most EV

registrations in Canada. Through April 2024, Quebec registrations

accounted for 50.6% of Canadian BEV registrations; British Columbia

counted for 20.6% and Ontario captured 22.5%.

Quebec and British Columbia account for more BEV registrations

than their natural registration distribution across the country. In

overall vehicle registrations, Ontario accounts for about 39% of

vehicle registrations, followed by Quebec at about 24%, Alberta at

12%, and British Columbia, which is narrowly behind Alberta at

11.6%. If BEV adoption in Canada mirrored overall vehicle

registrations, Ontario would also lead BEV registrations and be

substantially ahead of Quebec and British Columbia.

Instead, Quebec has held a leading position, followed by Ontario

and British Columbia. There is also evidence of some change here as

well, with Quebec's share of Canadian EV registrations taking a

significant jump the first four months of 2024.

However, when looking at registrations within each province, in

Ontario BEVs make up barely 5% of registrations in the province

from January through April 2024, compared with the national BEV

share at 8.5%. In British Columbia, BEVs accounted for nearly 15%

of vehicle registrations. In Quebec, BEVs accounted for 18% of

vehicle registrations. BEVs are overrepresented in Quebec, which

has the simplest BEV rebate logistically. In Alberta, there are

also no additional incentives, and BEV share there was 2.1%.

Currently, buying a BEV in British Columbia or Quebec has

potential for CA$9,000 in total incentives. The adoption of BEVs is

in Quebec is easily the strongest in Canada. And in those two

provinces, BEV share is far above the national average. In

high-volume provinces where there is no added incentive, BEV share

is lower than the national average. The provincial BEV incentive

programs are contributing to Quebec and British Columbia capturing

more BEV share than larger new-vehicle markets as well as being

well ahead of national BEV penetration.

State-level incentives have mixed impact in

US

In the US, BEV registrations are still highly concentrated in

the state of California. Like Quebec, California over indexes in

BEV registrations beyond what can be explained simply by its

state-level incentives. In the US, the states which offer

incentives also have more varied programs, which presumably creates

more variability in impact of state-level programs in the US.

California has also led with more strict vehicle emission rules

for decades, it has typically been a trend setting, early adopter

state inside and outside the auto industry as well as often being a

digital technology leader and embraced Tesla very quickly. In the

January through April period, California accounted for 34% of US

BEV registrations; the state's dominance of the BEV market is

assisted by state-level incentives. It was followed by Florida,

however, with 8% and no state-level incentives. Texas is third,

with 7% of US BEV registrations and a more modest US$2,500

incentive.

There are a total of 15 states in the US offering some level of

incentive on top of federal incentives, but BEV distribution in the

US does still generally see the highest volume states in overall

registrations also being the top BEV states. Within California

registrations, BEVs account for 21.4% of the total vehicles

registered, also far above the national-level BEV market share of

about 7%. BEVs accounted for 6.6% of total Florida vehicle

registrations, close to the national figure, while in Texas, BEVs

are at 5.2% of vehicle registrations so far in 2024.

The incentive in Texas, a more modest amount than California

offers, has not pulled the BEV share in Texas above the national

average. No other US state accounts for more than 4.5% of BEV

registrations, regardless of the size of any incentive.

Get a free trial of AutoIntelligence Daily.

![BYD to face Tesla in new market [Feature] BYD to face Tesla in new market [Feature]](https://i1.wp.com/www.teslarati.com/wp-content/uploads/2023/04/BYD-Seal-Debut.jpg?w=1300&resize=1300,800&ssl=1)