The S&P Global Mobility AutoIntelligence service

provides daily analysis of global automotive news and events. We

deliver timely context and impactful analysis for navigating the

fast-moving industry. Behind the Headlines offers a bi-weekly dive

into recent top stories.

In 2024, sales of battery electric vehicles (BEV) settled to

single-digit growth. Though BEV demand continues to grow, the

mismatch between naturally progressing demand and automaker

forecasts set the world on edge.

Given the billions invested and being deployed in the

transition, concern is warranted. Volume has largely increased,

though Tesla has seen softening demand for several of its products.

Tesla’s outsized share of BEV sales has a significant impact

outside of mainland China. At the same time BEV demand has entered

an inconsistent and choppy growth phase in most markets, mainland

China automakers are making inroads with less expensive BEVs. The

ability of some mainland Chinese automakers to offer lower-cost

BEVs and remain profitable has also set most other automakers on

edge, as BEV profitability remains elusive across the industry.

A bright moment in US light-vehicle registrations saw an 18%

year-over-year increase in battery electric vehicles (BEV)

registered in July 2024, the highest of the year so far and above

the 6.0% the overall market improved. The gain was supported by

increasing incentives as well as having more models available at

higher inventory levels. In July 2024, BEV share climbed to more

than 8%. Year to date, BEV registrations are at 7.6%, versus 7.2%

at the same point in 2023. BEV registrations grew 8.6% in the

January to July 2024 period; the total market has improved 2.5% in

the same period.

However, this pace is not what many automakers counted on when

making investment decisions in the 2020-2023 period and the first

half of 2024 was dominated by stories covering a perceived slowdown

in BEV demand. It is more accurate to say that BEV demand did not

meet high projections than to say demand was slowing.

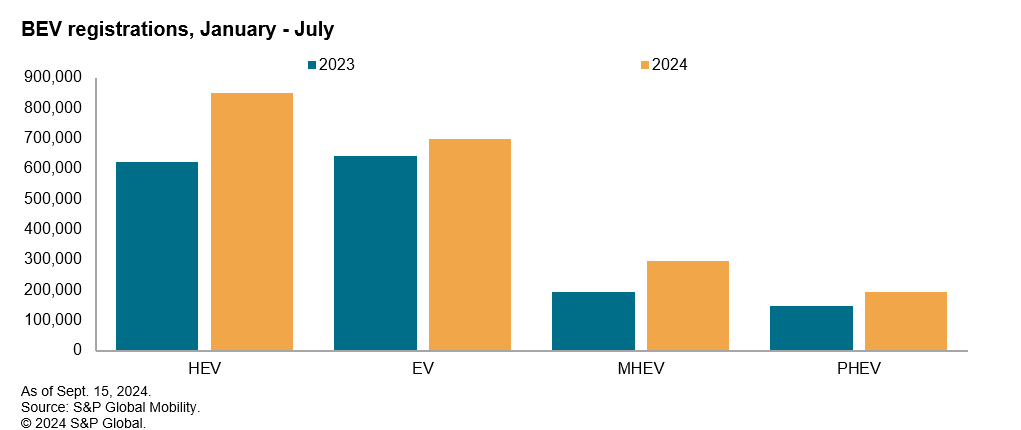

However, in the first seven months of 2024 US light-vehicle

registrations saw more growth in traditional hybrid-electric

vehicles (HEV). Plug-in hybrid electric vehicles (PHEVs) have

improved as well, though that solution still sees slower adoption

than either BEV or HEV. In July 2024, HEV registrations were at

10.4% of the total market and volume grew to just under 146,000

units for the month, compared with about 121,000 BEVs being

registered. In the January to July period, HEVs accounted for 9.2%

of all registrations.

The transition to BEV as a dominant propulsion system is likely

to continue to be inconsistent. Availability in terms of inventory

and vehicle segments still lags behind traditional internal

combustion engine vehicles, pricing is still higher than comparable

ICE products, infrastructure does develop slowly, and there are

still miles to go in terms of consumer education, awareness and

engagement. These issues take time to resolve.

In the meantime, many automakers are revising timing for BEV

investment. BEV profitability remains elusive and there remains the

need to support customers not ready to make the BEV switch, while

still addressing regulations. In 2024, it has become obvious that

the transition to BEV dominance will be inconsistent and less

predictable. HEV and PHEV will remain important for a longer period

than some automakers were targeting.

Automakers are adjusting their plans to ensure the right product

mix at the right time as well as managing capital investment

carefully. BEV production targets have been cut in the immediate

term, products canceled or delayed, longer-term BEV targets

adjusted, and capital investment re-timed. Automakers have not

abandoned the longer-term goal of zero emissions vehicles as part

of the path to a bigger goal for net zero carbon emissions.

Ford and GM have both retimed BEV capacity development, delaying

when programs will come on line and how quickly capacity is being

increased. Ford most recently cancelled two BEV three-row utility

vehicles in the Ford Explorer and Lincoln Aviator space and will

use hybrid electric propulsion systems instead. GM lowered

production targets for 2024 and 2025 and delayed the retooling of a

BEV full-size truck plant. GM has not announced as many changes to

specific product plans but is expected to have canceled or delayed

several projects internally as well. GM’s Cadillac division has

stepped back from its plans to shift to an all-BEV lineup by 2030,

and now says it will offer the “luxury of choice” when it comes to

powertrains. GM has delayed opening of its planned fourth US

battery plant to 2027, aligning with the delays in BEV production

plans, and its partner LG Energy Solutions is slowing development

of one of its US battery plant projects.

Mercedes-Benz and Volvo Cars have also slowed some of their

expectations for electrification. Volvo Cars dropped its forecast

from expecting 100% electrified powertrains (BEV or PHEV) in 2030

to between 90% and 100%. Volvo Cars does expect to see 50% of its

sales in 2025 be electrified vehicles, however. Mercedes-Benz is

increasing investment in ICE projects to ensure its engines remain

competitive as the change to BEV has not come as quickly as it

expected, and Mercedes-AMG has said it will maintain V8 engines

longer than planned.

On the other hand, Hyundai announced a major strategy update to

invest billions more into electrification as well as targeting

annual sales of 5.5 million by 2030; by 2030, Hyundai expects 36%

of its global sales to be BEVs, though also planning an extended

range BEV by late 2026 and not letting up on its goals for hydrogen

powertrains. After Hyundai announced plans to spend US$90 billion

over the next 10 years to support its initiatives, GM and Hyundai

announced a memorandum of understanding to discuss potential

partnerships for platforms, electrified vehicles and BEVs. It is

far too soon to know what will result from those talks. Yet, if the

two companies work together to reduce costs over the next decade,

this could have a substantial impact on the market by making more

affordable electrified products available faster while the

automakers potentially see profitability faster.

Though a transition to zero emissions transportation remains a

central target, consumers are weighing in. In 2024, consumer

purchase behavior is causing automakers to rethink investment

timing. The dynamics of this year reinforce the complex nature of

the change to increasing BEV adoption, that consumers do hold

significant power along the way, and the importance of a nimble

corporate strategy.

Get a free trial of

AutoIntelligence

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.