Tesla CEO Elon Musk, in Thursday’s annual shareholder meeting, called himself “a helpful accelerant” to the company’s future, as shareholders approved a pay package for Musk valued at $46 billion based on current stock prices.

Meanwhile, one aspect that was due to change the company’s trajectory, cut costs, and enable everything from a $25,000 Tesla EV in 2023 to mass-production of the Semi in 2021 hasn’t yet arrived in 2024: the dramatic cost reductions of Tesla’s 4680 cells.

“With respect to our own cell production, we do see a path to cost parity by the end of this year—a very difficult path to cost parity,” Musk summed.

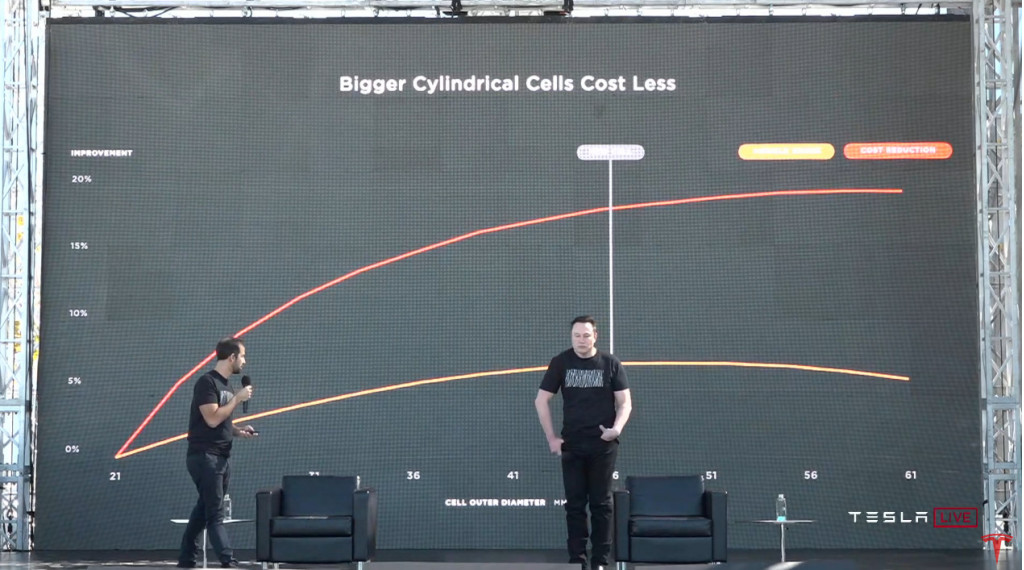

Battery Day and 4680 aimed to halve the cost

Musk still in 2024 talking about getting cost parity with commercial cells in sight is a very different, sobering outcome than the company had hoped for when it revealed the strategy as part of its September 2020 Battery Day. Tesla made the 4680 cells and its own future production of them the centerpoint of that event and claimed it would make the breakthrough cell at half the cost, on an energy basis, versus suppliers—and boasted that it could even supply it to other automakers.

Comparing 4680 vs. 2170 – Panasonic

“Currently our 4680s cost more than our suppliers’,” Musk revealed on Thursday, as he noted the volatility of EV battery prices. “They cost more than the suppliers’ today but they cost less than the suppliers’ a year ago.”

“There’s a bit of a feast-famine thing with battery cell suppliers, kind of for VRAM chips,” he added. “But we expect to achieve cost parity, even be much lower than the supplier cell price today, by the end of the year.”

Tesla’s big battery bet hasn’t paid off—yet

The cost of EV battery cells has indeed been a rollercoaster ride. After Battery Day, EV battery cost soared to new heights in 2022, hampering EV affordability. Lithium-ion battery prices dropped through 2023 and into this year, but they’re not showing signs of stopping. Goldman Sachs analysts now anticipate a nearly 40% decline in EV battery prices between 2023 and 2025, which in turn will boost sales.

Tesla Battery Day – Bigger costs less

In so many respects, the economics of EV battery supply are looking very different than how they presented around Battery Day. There is now such a global glut in battery production, if you consider China, that China itself now makes enough batteries to cover all global EV production, according to an assessment earlier this spring by Bloomberg New Energy Finance. And in format, no other major automaker has yet committed to the 4680 cylindrical format (46 mm diameter, 80 mm height). BMW has, for instance, instead committed to 4695 (same 46 mm diameter, greater 95 mm height).

Musk had said in 2021 that without Tesla’s own production of the 4680 cells, it wouldn’t have enough for mass-production of the Semi—a stage of Semi ramp that Musk only confirmed in this week’s event.

In 2021, Panasonic’s top battery executive said that mass-producing the 4680 cell format would “require new techniques.” But that didn’t stop it and other top battery suppliers from vying to make the new format.

2025 Tesla Cybertruck – Courtesy of Tesla, Inc.

Tesla’s VP of engineering Lars Moravy did give an update on 4680 production during the company’s Q1 financial call in April, suggesting it’s at a rate leading to about 7 gigawatt-hours per year, with enough to stay ahead of the production ramp of the Cybertruck, which is otherwise the only model to use them.

As Musk’s comments from Thursday suggest, Tesla may soon be able to match other batteries and battery makers, but half the cost still looks as far away now as it did in 2020.