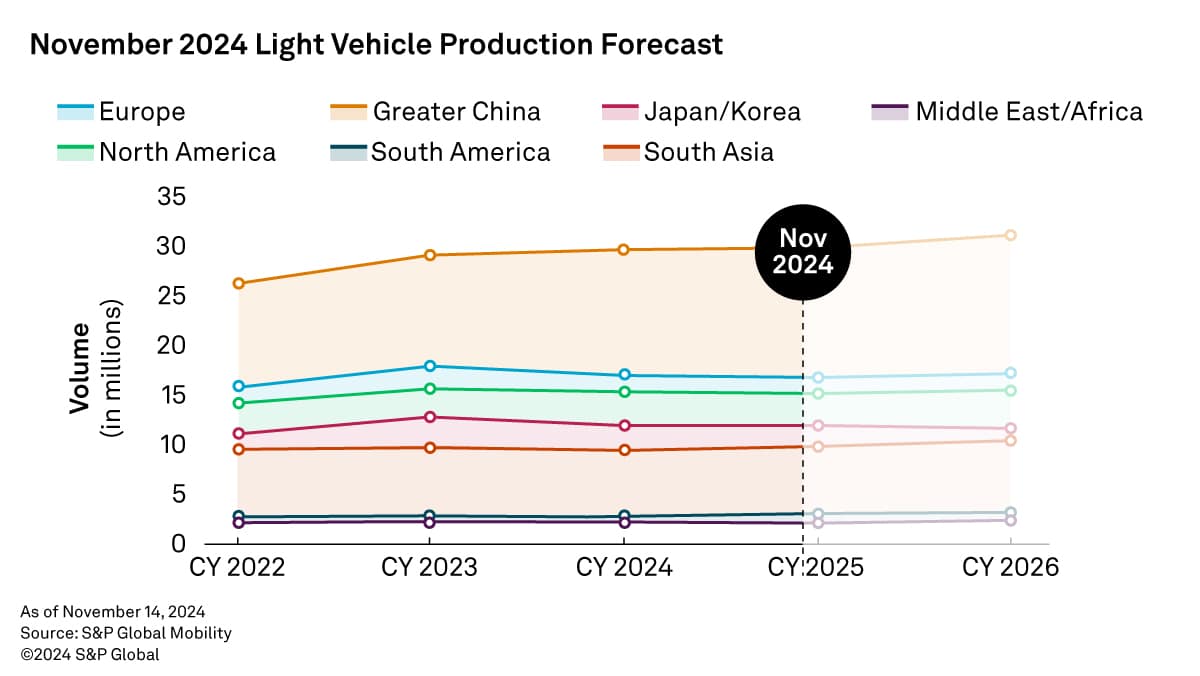

Each month, we leverage global light vehicle production actuals,

registration data, and sales data to provide the most up-to-date,

short-term production forecast available.

Here's a close look at global production data by region and our

updated November production forecast.

Top Takeaways for the Month

Light vehicle production forecasts are mixed globally, with

notable downgrades in Europe and South Asia, while Greater China

sees an upward revision due to improved sales from government

scrappage subsidies. The US elections have introduced uncertainties

that are expected to negatively affect BEV volumes and the

electrification mix. Overall, the 2024 production outlook is

slightly stronger, but ongoing inventory management and demand

dynamics continue to pose challenges across various regions.

Noteworthy Adjustments

Europe: The light vehicle production outlook

for Europe has been downgraded by 92,000 units for 2024, primarily

due to reduced forecasts for Stellantis and Volvo. Concerns over

potential strikes and production disruptions, including flooding in

Spain, have further impacted the forecast.

Greater China: Greater China's production

outlook has been increased by 409,000 units for 2024, driven by a

recovery in sales supported by scrappage subsidies. The market is

expected to grow by 2.4% year-over-year, although economic

uncertainties may temper future projections.

Japan/Korea: Japan's production outlook for

2025 has been upgraded by 39,000 units, with Toyota expected to

maintain strong momentum. In contrast, South Korea's production

forecast for 2024 has been reduced by 12,000 units due to

disappointing domestic sales and exports.

North America: North America's production

outlook remains largely unchanged and continues to generally

reflect needed inventory correction. Ford's production for 2025 has

been revised down by 45,000 units on the expected need to de-stock

as we enter the new year. Additionally, production for Stellantis

for 2024 was reduced by 48,000 units due to meaningful production

downtime in Q4-2024 in order to rein in elevated inventories.

South America: The South American light vehicle

production outlook has been increased by 23,000 units for 2024,

attributed to stronger-than-expected production results in Brazil

and Argentina. Adjustments for 2025 and 2026 were minor, focusing

on vehicle timing changes.

South Asia: South Asia's production outlook has

been reduced by 63,000 units for 2024, driven by production

weaknesses in the ASEAN market and high inventory levels in India.

Downward revisions for 2025 and 2026 reflect incremental domestic

and export demand challenges, particularly in the ASEAN market.

Download a free light vehicle production forecast sample

here.