This content is also available

on our LinkedIn newsletter.

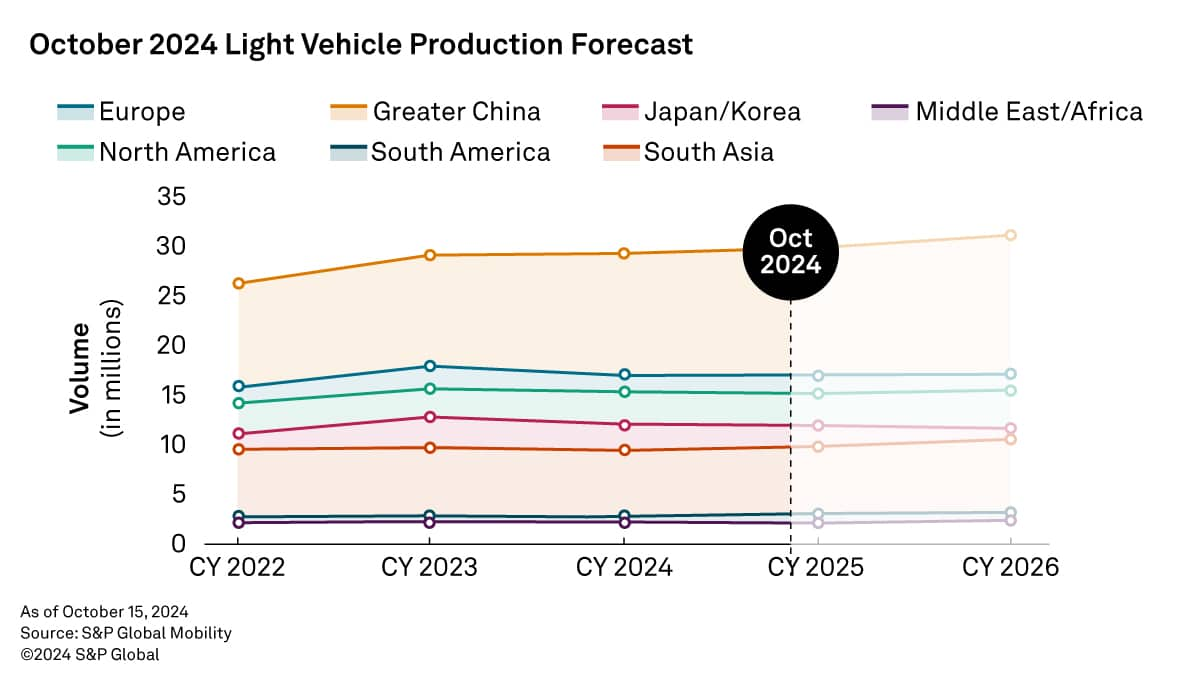

Each month, we leverage global light vehicle production actuals,

registration data, and sales data to give you the most up-to-date,

short-term production forecast available.

Here’s a close look at global production data by region and our

updated October production forecast.

As we enter the fourth quarter of 2024, slower growth in

significant regions and uncertainties surrounding battery electric

vehicle (BEV) adoption continue to challenge the production

outlook. This month’s forecast notably revises Europe downward due

to reduced demand and mandated fleet emissions requirements, while

Greater China sees a modest improvement thanks to government

stimulus.

Europe: The European light vehicle production

outlook was reduced by 107,000 units for 2024 and 292,000 units for

2025, driven by weakening demand in Central and Western Europe. An

EU reduction mandate of 15% for fleet emissions in 2025 will

pressure OEMs to manage supply to the market effectively. In

contrast, Eastern Europe sees an increase of 35,000 units for 2025,

supported by Russian demand.

Greater China: In Greater China, our light

vehicle production outlook was increased by 73,000 units for 2024

but decreased by 42,000 units for 2025. NEVs are the primary growth

driver, continuing their strong momentum with 1.1 million retail

units sold in September. A fundamental consumption recovery is not

expected this year, even as the scrapping policy provides modest

support.

Japan/Korea: The Japan light vehicle production

outlook was upgraded by 22,000 units for 2025 and 128,000 units for

2026, with a key driver being a change in sourcing for the Nissan

Leaf North America, from the UK to Japan. South Korea’s production

outlook was reduced by 9,000 units for 2024 and 16,000 units for

2025, reflecting slower sales in Europe.

North America: The North American light vehicle

production outlook was decreased by 12,000 units for 2024 and

113,000 units for 2025, with the revisions for next year driven by

a variety of vehicle program delays. Inventory management efforts,

particularly for the Detroit 3, continue to influence the near-term

production outlook for the region.

South America: South America’s light vehicle

production outlook was increased by 36,000 units for 2024 and

35,000 units for 2025, driven by stronger sales in Brazil and

generally improved demand expectations for Argentina.

South Asia: The South Asia light vehicle

production outlook was increased by 25,000 units for 2024 but

reduced by 73,000 units for 2025. The ASEAN market shows stronger

recent production activity, while India’s production outlook has

been meaningfully revised down for 2025 and beyond, due to economic

challenges and high inventory levels.

Download a free light vehicle production forecast sample

here.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.