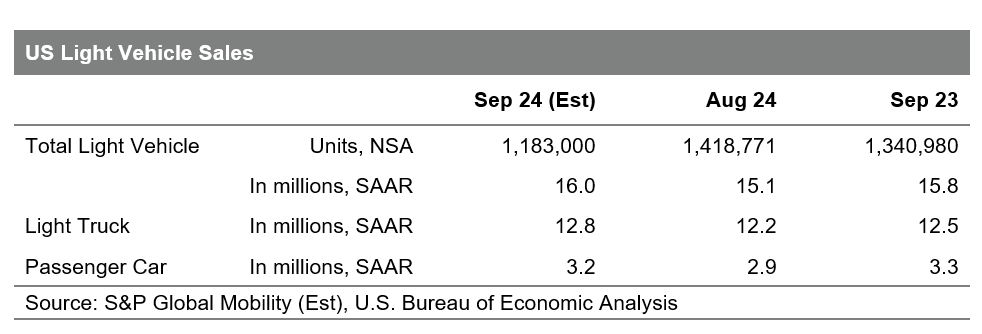

On a volume estimate of 1.18 million units, US light vehicle

sales in September are expected to realize a calendar-induced

decline of approximately 12% year-over-year.

On the bright side, this would translate to a seasonally

adjusted annual rate (SAAR) of 16.0 million units, a notable bump

from the 15.2 million unit reading in August and sustaining a

volatile pattern for this monthly metric since May. The

month-to-month volatility in the SAAR reading reflects the current

state of auto demand.

“New vehicle sales remain stuck in neutral,” said

Chris Hopson, principal analyst at S&P Global Mobility.

“The overall tenor of the auto demand environment remains one of

consistent, but unmotivated volume levels as consumers in the

market continue to be pressured by high interest rates and

slow-to-recede vehicle prices, which are translating to high

monthly payments.”

Despite increasing to 2.88 million units at the end of August,

dealer advertised inventory in the US has also largely leveled out

since the spring. “With 2025 model year vehicles now becoming

available at an increased rate (up 65% vs. July), pressure to sell

down remaining stock of 2024 model year vehicles will begin to

mount,” suggests

Matt Trommer, associate director of product at S&P Global

Mobility.

Continued advances in inventories and incentives are expected,

but given reports of some automakers culling output expectations

for the remainder of the year, affordability issues are expected to

remain stubbornly sticky even as the first interest rate cut was

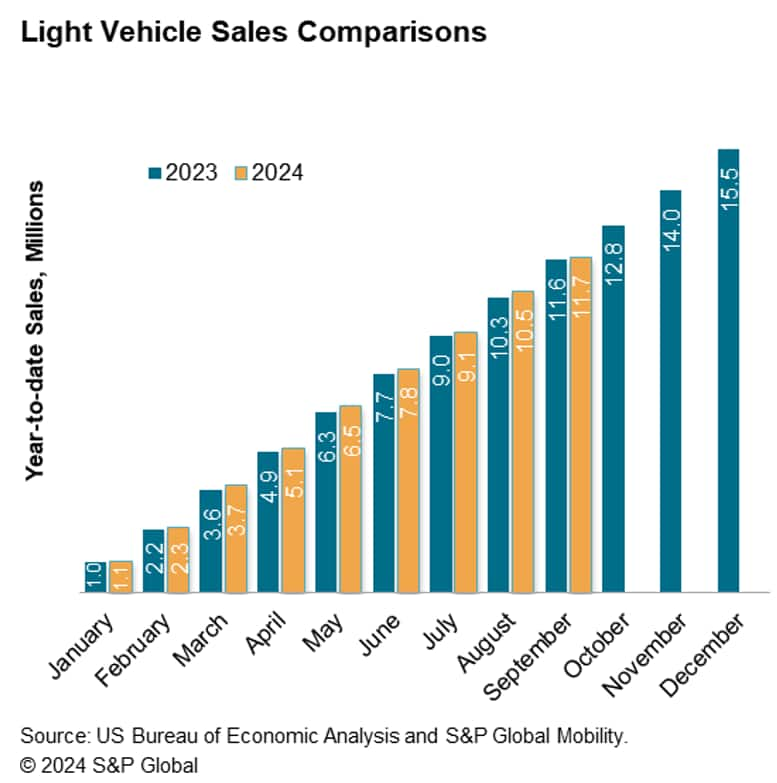

made. In our September 2024 forecast update, we’ve lowered our

calendar year 2024 US sales outlook to 15.9 million units, down

from a previous projection of 16.0 million units. Similarly,

our light vehicle production outlook for North America has also

been downgraded to a 2024 calendar year projection of 15.5 million

units, reflecting vehicle timing and inventory correction

impacts.

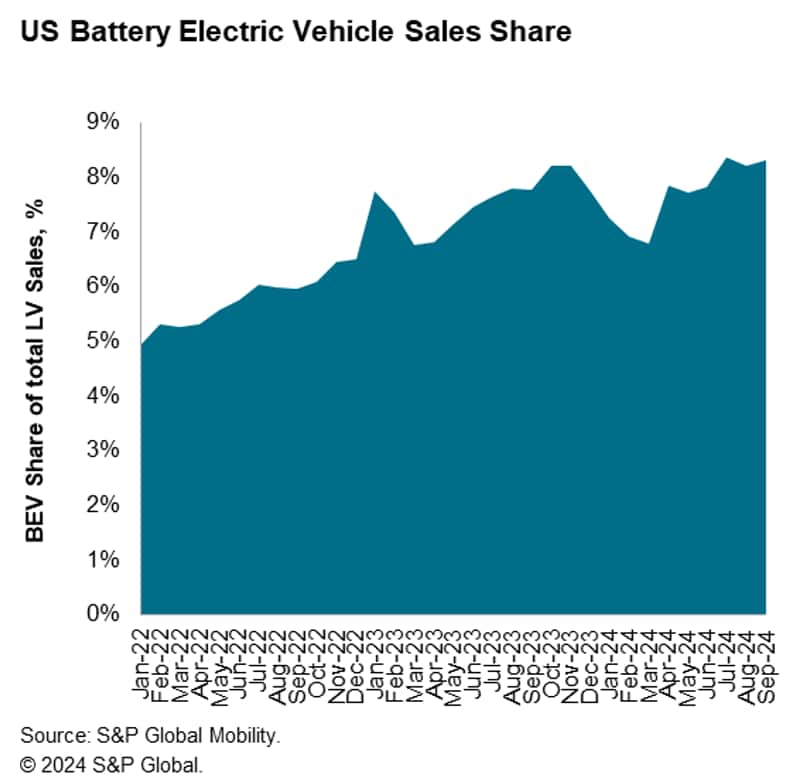

Strong development of battery-electric vehicle (BEV) sales

remains an assumption in the longer term light vehicle sales

forecast. According to S&P Global Mobility’s new registration

data, BEV share of sales has been above 8% in both June and July,

progress from levels earlier in the year. In the immediate term,

moderate month-to-month volatility is anticipated. September BEV

share is expected to remain above 8% once again.

Assisted by the current roll outs of vehicles such as the

Chevrolet Equinox EV and Honda Prologue and to be followed by new

BEVs such as the Polestar 3, Jeep Wagoneer S and Volkswagen ID.

Buzz slated for release in the fourth quarter, electric vehicle

sales are expected to advance over the remainder of the year.

Get a free preview of our Light Vehicle Sales

Forecast.

Download Forecast.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.